Who knows, one day you might want to sell your bitcoins for whatever reason. You can either use third-party exchanges and deposit your money into a bank account or sell bitcoins in person for physical cash. Services like Lolli and Moon allow you to shop online using Bitcoin and other popular cryptocurrencies. Even better, you can get maximum discounts as well as earn some bitcoins while you spend. Check out this article to help you spend Bitcoin smarter. The easiest way to cash out Bitcoin is through an online cryptocurrency exchange.

The following are a few main options where you can sell Bitcoin based on your country:. Founded in June , LocalBitcoins is a P2P Bitcoin exchange that facilitates direct trading between potential buyers and sellers. Serving more than 1.

How to cash out Bitcoin

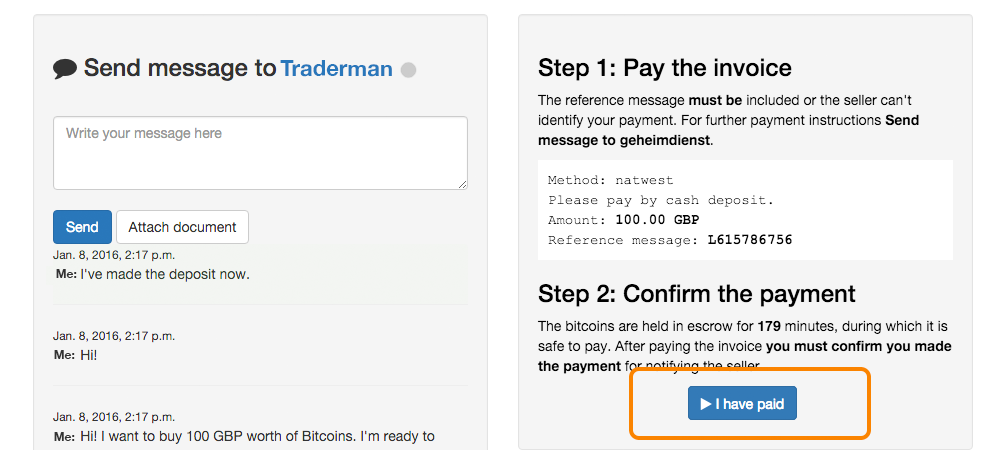

In fact, only New York state has suspended their services due to local financial regulations. Plus, it offers escrow service to protect both buyers and sellers of Bitcoin. Apart from that, you can decide how much you want to sell your Bitcoin for, as well as request any payment method that you like. You can choose from a variety of payment methods, including cash deposit, bank transfer, Payoneer, Paypal, gift vouchers, Western Union or in-person cash.

Confirm the amount of BTC you want to sell, enter your payment details for example, provide your PayPal email address or bank account. Wait for the buyer to send the payment. Complete transaction once the fund is received. The best part? Buying and selling bitcoins on LocalBitcoins is completely free. This is because they provide escrow, mediate transactions and resolve any dispute.

- Step 2: Transfer your Bitcoin to your exchange wallet.

- bitcoin highest dollar price.

- Best Way to Sell Bitcoin in Each Country?

Bitcoin ATM is a hassle-free way to convert Bitcoin into cash. Bitcoin ATM is rather a physical centre, allowing you to buy Bitcoins with fiat money. And the good news is some ATM machines let you sell your Bitcoins for local currency too.

Cash Bitcoin Exchanges

I t will show you a live worldwide Bitcoin ATM map. Then search for a Bitcoin ATM that offers the option to sell bitcoins for cash. However, this method is only suitable for small transactions. Still, the biggest drawback of using Bitcoin ATM is its high transaction fee. Compared to online exchanges which charge an average 0.

Bitcoin Withdrawals

Clearly, convenience comes at a higher cost. In case you need to cash out bitcoins quickly, Bitcoin ATM can be the most feasible option. Some popular Bitcoin debit cards are Crypto.

- How to Buy Bitcoin.

- bitcoin stopped trading.

- Can I Withdraw Cash from A Bitcoin ATM?;

- bitcoin to aud history!

- horizon prize bitcoin.

- bitcoin core tcp port;

Each card comes with different features, fee structures and services. Platts publishes price assessments for Dubai oil and the Dubai Mercantile Exchange trades futures for Omani crude. Both act as benchmarks for Middle Eastern shipments to Asia. Abu Dhabi says the combination of high supply, easy access to oil-consuming markets from Fujairah and the absence of trading restrictions will attract plenty of buyers to its exchange. The futures platform will be run by Atlanta-based Intercontinental Exchange Inc. The Murban exchange and the capacity boost could raise tension within the Organization of Petroleum Exporting Countries, according to Hari of Vanda Insights.

The Gulf states dominate the cartel and tend to prize unity. They also began unprecedented production cuts last year to bolster prices as the coronavirus pandemic spread. Bloomberg -- As the global economy picks up speed, investors are dusting off the Canada playbook. Covid vaccinations are gaining momentum and fiscal support is helping the growth outlook, lifting bond yields. Global investors have overlooked Canada for years in favor of countries with greater choice in high-growth technology stocks, primarily the U.

Canadian equity exposure is also increasing, according to Bank of Nova Scotia analysts. They say the valuation gap with U. Financials are nearly one-third of the benchmark; rising rates and an improving economy help insurers such as Manulife Financial Corp. The first decade of this century was better for emerging markets such as Brazil and commodities-driven developed countries including Canada. Bloomberg -- Nomura Holdings Inc. The Tokyo-based firm also canceled plans to sell dollar-denominated bonds. While the Nikkei newspaper reported that the losses arose at its U.

Nomura said the estimate of the claim against the client may change depending on unwinding of the transactions and market price fluctuations. It will continue to take steps to address the issue and make a further disclosure once the impact of the potential loss has been determined.

Updates with Nikkei report in the fourth paragraph For more articles like this, please visit us at bloomberg. Mortgage rates were on the rise once more last week. The upward trend in rates and home prices is beginning to take effect on refinancing and demand.

Post navigation

The trades were linked to sales of holdings by Archegos Capital Management, a person with knowledge of the matter told Reuters. West Texas Intermediate lost as much as 2. Crude has been hit by rising volatility in recent sessions, with WTI swinging between gains and losses last week. Traders were also tracking the advent on Monday of a significant new contract, with Abu Dhabi kicking off futures for its oil in a bid to establish a new regional benchmark. Oil is still set to close out a fourth consecutive quarterly gain this week, aided by sustained supply curbs imposed by the Organization of Petroleum Exporting Countries and its allies, and optimism that global demand will expand as coronavirus vaccines get rolled out.

Rates for tankers had increased, boosting the cost of shipping crude around the world. Despite progress with vaccines, the Covid pandemic remains a challenge.

Global cases rose for a fifth week, with several European nations facing a resurgence. Also in Asia, the Philippine capital is also back under strict curbs. This time around, Goldman Sachs Group Inc. Citigroup Inc. Bloomberg -- The family office of former Tiger Management trader Bill Hwang was behind the unprecedented selling of some U.

The companies involved ranged from Chinese technology giants to U. ViacomCBS and Discovery posted their biggest declines ever Friday, after the selling and analyst downgrades. The liquidation had triggered price swings for every stock involved in the high-volume transactions, rattling traders. Hwang was an institutional stock salesman at Hyundai Securities Co.

Updates with reasons behind selling in second paragraph For more articles like this, please visit us at bloomberg. Production constraints elsewhere in the world had seen prices for many commodities gain momentum in the early part of , the department said. Price gains are likely to moderate, leading to a modest decline in resources earnings in fiscal , although growth in demand for the materials vital to the clean energy transition is seen buoying the industry out to and beyond.

Kavcioglu was appointed on March 20 after President Recep Tayyip Erdogan fired Naci Agbal from the central bank, two days after a larger-than-expected rate increase. That preoccupation has seen the president fire three central bank three governors in less than two years. Now, after his shock appointment, Kavcioglu is the latest to hold the post. The central bank will try to amass foreign reserves when market conditions are right, Kavcioglu said, a policy priority he shares with Agbal.

A survey shows rates are higher for a sixth week, but they might already be pausing. Goldman even emailed clients late Friday to inform them that it had in fact been one of the banks selling. Efforts to reach Hwang and his associates at Archegos were unsuccessful.

How do I easily buy and sell Bitcoin?

In , he pleaded guilty on behalf of his firm, Tiger Asia Management, to U. Back in , Goldman was wrestling with the reputation damage from the 1MDB scandal in Malaysia as well as still trying to restore its name after the financial crisis. Force of its OwnAt some point in the past two-and-a-half years, the firm changed its mind about Hwang.

One possibility: The firm decided that, after a decade since his illegal trades, Hwang had spent enough time in the penalty box. Archegos had also become a force of its own, a family office that was bigger than many hedge funds. By Friday morning, some banks had started exercising the right to declare him in default and liquidate his positions to recover their capital, according to people familiar with that situation. Others swiftly followed. That triggered a mad dash to sell shares in huge blocks as one bank after another scrambled to avoid losses on stocks that soon would be plummeting in value.

The mammoth cargo ship marooned in the Suez Canal has the potential to inflict damage on a global economy still recovering from the COVID pandemic. Copper prices rallied on Friday, making up some of the losses of earlier this week, fueled by optimism about near-term demand in Asian markets. While some of the stocks targeted in the block trades initiated by Goldman Sachs Group Inc.

They posted their biggest daily losses ever.

Morgan Stanley was shopping a large block of ViacomCBS shares on Sunday, according to a person familiar with the matter. About 45 million shares were offered on behalf of an undisclosed holder, the person said. Futures on the Nasdaq dropped 0. Huge RalliesThe possibility of additional block trades still looms over the market, while the traditional end-of-quarter volatility may contribute to sharper swings on high-flying stocks.

ViacomCBS and Discovery have rallied this year. The stock fell 9. On Friday, a downgrade by Wells Fargo and the large block trades compounded the selling pressure.